Effectively managing expenses in manufacturing isn’t just an option — it’s a necessity. For example, you can allocate depreciation costs of refrigerators to the department that uses them. To obtain these details, you can refer to the company’s employment records that has a list of all the employees and their hourly rates. For instance, let’s say a company has an existing inventory worth $1,500. A project cost overrun happens when the project costs exceed the budget estimate.

Step #3: Add up the other direct expenses

Each of them requires a different set of cost control measures, making appropriate cost categorization even more essential. For instance, if the manufacturing costs are too high, these costs can create a dent in the company’s profit. In this case, the management can decide to stop the production of some goods and invest in developing new ones that have a lower cost of production. The key takeaway of this case study is that understanding the fluctuations in manufacturing costs can empower companies to make informed and timely choices between outsourcing and in-house production. These informed decisions help in maximizing productivity and profitability. As a result, the company decided to outsource production to a contract manufacturing company (a company that enters into a contract with the manufacturer to make certain components) instead of assembling components in-house.

Examples

Advertising, market research, sales salaries and commissions, and delivery and storage of finished goods are selling costs. The costs of delivery and storage of finished goods are selling costs because they are incurred after production has been completed. Therefore, the costs of storing materials are part of manufacturing overhead, whereas the costs of storing finished goods are a part of selling costs. Remember that retailers, wholesalers, manufacturers, and service organizations all have selling costs. Some materials (such as glue and thread used in manufacturing furniture) may become part of the finished product, but tracing those materials to a particular product would require more effort than is sensible. Such materials, called indirect materials or supplies, are included in manufacturing overhead.

Resources

- For this reason, firms expense (deduct from revenues) period costs in the period in which they are incurred.

- Some materials (such as glue and thread used in manufacturing furniture) may become part of the finished product, but tracing those materials to a particular product would require more effort than is sensible.

- This helps them understand the most efficient process and the investment they need to make for the selected process.

- Therefore, businesses typically establish and adhere to their own criteria.

- The wood used to build tables and the hardware used to attach table legs would be considered direct materials.

MasterCraft records these manufacturing costs as inventory on the balance sheet until the boats are sold, at which time the costs are transferred to cost of goods sold on the income statement. For instance, managers of consumer goods companies such as Procter & Gamble and Anheuser-Busch prefer to allocate the high expense of advertising to a certain product. For instance, Ford Motor Company has reduced the price of F-150 Lightning, its electric car, by $10,000.

Example #1: Direct materials

These costs include the costs of direct materials, direct labor, and manufacturing overhead. Administrative expenses are nonmanufacturing costs that include the costs of top administrative functions and various staff departments such as accounting, data processing, and personnel. Executive salaries, clerical salaries, office expenses, office rent, donations, research and development costs, and legal costs are administrative costs.

Products

The relevance of costing to manufacturing companies is highly important to running an efficient and successful business. Identifying, separating and apportioning cost data provides management and outside decision makers (investors) valuable information on the company’s profitability and cost control systems. Non-manufacturing costs refer to expenses that are not directly tied to the production of goods or services. These costs encompass a variety of expenses such as selling, administrative, and research and development costs, which support the overall operations of a business but do not contribute to the creation of products. Understanding non-manufacturing costs is essential for effective budgeting and financial planning as they impact overall profitability and can influence pricing strategies.

These costs are not directly tied to the production of goods or services, but rather to the overall operation of the company. Examples of period costs may include rent, salaries and wages of administrative staff, office supplies, marketing and advertising expenses, and other similar expenses. While these costs are necessary for the overall functioning of the business, they do not directly contribute to the production of goods or services. Manufacturing costs refer to those that are spent to transform materials into finished goods. Manufacturing costs include direct materials, direct labor, and factory overhead. Firms account for some labor costs (for example, wages of materials handlers, custodial workers, and supervisors) as indirect labor because the expense of tracing these costs to products would be too great.

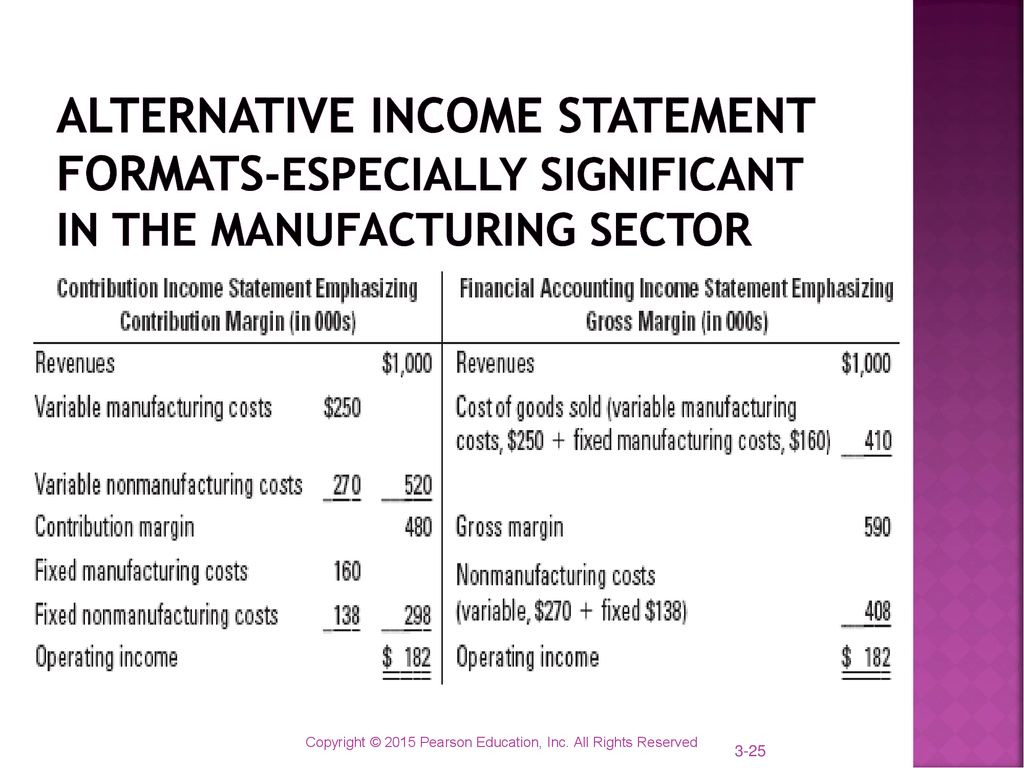

For accounting purposes, nonmanufacturing costs are expensed periodically (typically in the period they are incurred). However, for management objectives, managers frequently require the assignment of nonmanufacturing get a letter from the irs in 2020 read this costs to goods. This is especially true for specific product-related commissions and promotions. Nonmanufacturing, also known as “period” costs, consists of selling and administrative expenses.

Manufacturing costs are recorded as assets (or inventory) in the company’s balance sheet until the finished goods are sold. Another commonly used term for manufacturing costs is product costs, which also refer to the costs of manufacturing a product. Calculating manufacturing costs helps assess whether producing the product is going to be profitable for the company given the existing pricing strategy. Cost control, according to Fabrizi, is one of the top benefits of calculating manufacturing costs. While this is a simplified view of direct labor calculation, accountants also include the benefits, overtime pay, training costs, and payroll taxes when calculating the hourly rate. For a further discussion of nonmanufacturing costs, see Nonmanufacturing Overhead Costs.

Period expenses are closely related to periods of time rather than units of products. For this reason, firms expense (deduct from revenues) period costs in the period in which they are incurred. Accountants treat all selling and administrative expenses as period costs for external financial reporting.

The company has been able to do so by consistently working on improving the efficiency of production and lowering manufacturing costs. For that purpose, the company used sensors to collect and analyze the cost of materials in real time to see how to optimize the costs. Be sure to allocate overhead costs to the respective cost centers (specific departments, processes, or machines in the manufacturing facility that contribute to the manufacturing costs). Manufacturing costs, also called product costs, are the expenses a company incurs in the process of manufacturing products.